Main navigation

Eligibility and Plan Description

Regular benefit-eligible employees with a 50% time or greater appointment are eligible for the university’s group term life insurance program.

- Coverage is required for eligible employees.

- No health statement or physical examination is needed.

The university contributes toward the cost of the Group Life Insurance plan. Coverage is provided at two times your annual salary.

Per IRS guidelines, life insurance coverage exceeding $50,000 is considered a taxable benefit. The value of coverage above this threshold will be reported as imputed income.

Enrollment Instructions

Regular Benefit-Eligible Employees

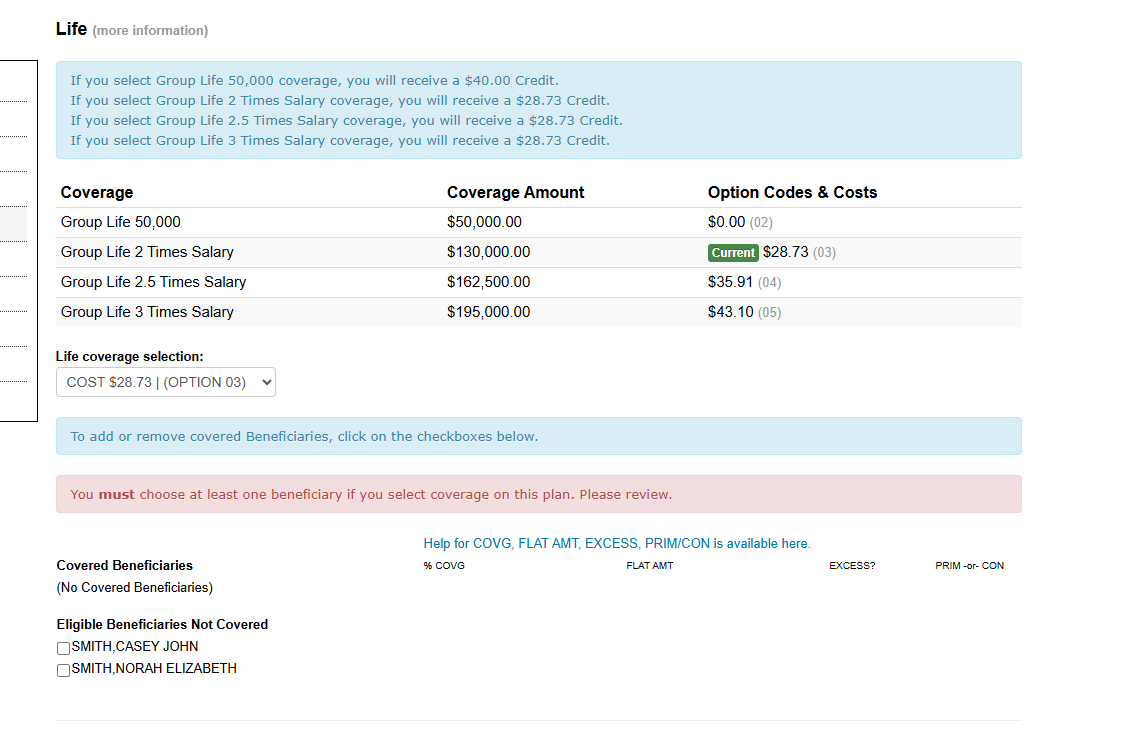

- You may choose from four levels of coverage (for yourself only).

- The university automatically provides coverage equal to two times your salary:

- If you choose only $50,000 in group life coverage, you will receive a $40 shared savings credit added to your $90 general benefit credit.

- Two times your salary would be no cost to you.

- The additional coverage options are available for an extra cost, minus the twice your salary amount you receive from the university.

- Regular employees should see a blue calculations box above the coverage section showing them the amount of credits that would apply to each coverage option.

To enroll:

- Select your coverage level using the drop-down menu.

- Use the Option Code (number in parentheses next to the price).

- Review and update beneficiaries.

- Assign benefit amounts.

Need help adding a beneficiary? Visit the section below titled "Review and Update Beneficiaries" for step-by-step instructions on how to add a new beneficiary to your enrollment.

House Staff Residents/Fellows

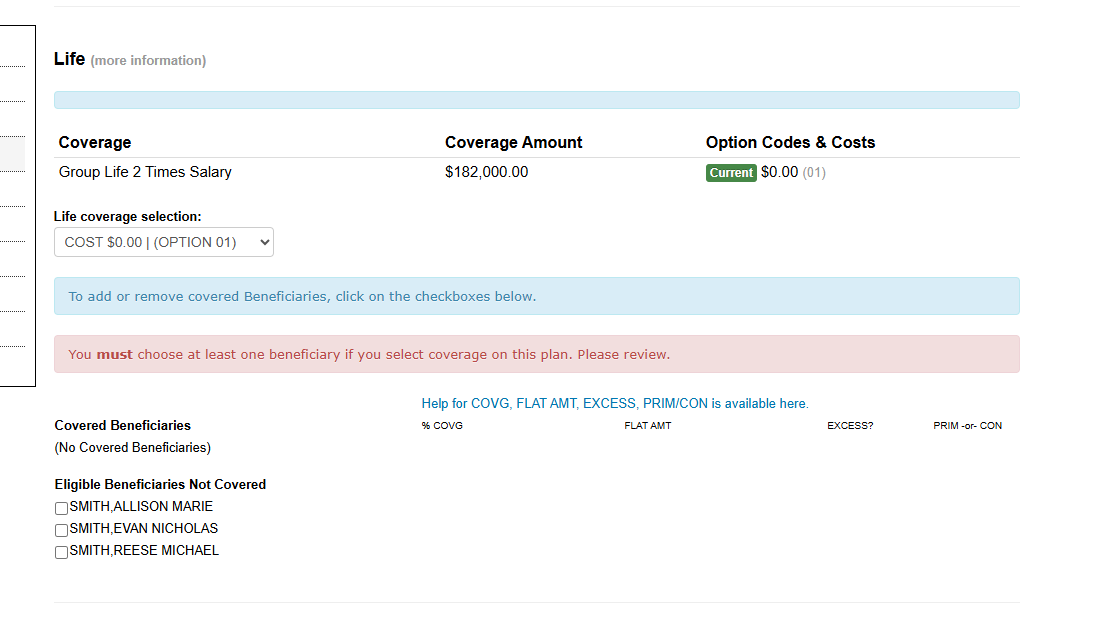

- Coverage is for yourself only.

- Automatically enrolled in coverage equal to two times your salary.

- Additional coverage may be purchased through the Voluntary Term Life (VTL) program.

To manage your enrollment:

- No action needed for basic coverage—Option Code is pre-selected.

- Review and update beneficiaries.

- Assign benefit amounts.

- To elect additional coverage, visit the Voluntary Term Life Insurance section.

Need help adding a beneficiary? Visit the section below titled "Review and Update Beneficiaries" for step-by-step instructions on how to add a new beneficiary to your enrollment.

Review and Update Beneficiaries

You must have at least one beneficiary listed and assigned to complete your enrollment.

If you do not have a beneficiary already listed, or if there is no one under the "Eligible Beneficiaries Not Covered" section that you can add:

- Select the "Save for Later" button at the bottom of your screen and return to the beginning of your enrollment.

- Select the black button labeled "I AGREE - VIEW & UPDATE DEPENDENTS/BENEFICIARIES"

- Follow the prompts to add a new beneficiary.

- Re-enter your enrollment event and locate your newly added beneficiary that should now be listed under the "Eligible Beneficiaries Not Covered" section.

- Select the checkbox next to their name and click the blue "Recalculate" button to refresh your beneficiary lists. Your newly added beneficiary will appear under the "Covered Beneficiaries" section.

- Assign benefit amounts:

- Enter either a percentage or a flat dollar amount for each beneficiary.

- Total primary beneficiaries must equal 100%

- Total contingent beneficiaries (marked as CON) must equal 100%

- Use the blue "Recalculate" button again to refresh your elections.