Main navigation

As part of our commitment to compliance and transparency, this page provides vital information on ACA reporting, waiving health insurance and university credits, and the ACA health insurance offers process.

Affordable Care Act Tax Forms

Employees

IRS Form 1095: Statement of Health Coverage

As part of the Affordable Care Act (ACA), the University is required to provide IRS Form 1095-C (1095-B, where applicable) to all full-time employees. This form serves as documentation of the health coverage offered to you and your family (if applicable) during the previous calendar year.

Important Update - November 2025

Changes to How You Receive IRS Form 1095

Due to recent changes in federal law under the Paperwork Burden Reduction Act, the University will no longer automatically mail paper copies of Form 1095 to employees.

What This Means for You:

- Starting with the current tax year, Form 1095 will be delivered electronically through Employee Self-Service.

- You will receive an email notification each January when your form is available to view, print, or download.

- If you prefer to receive a paper copy by mail, you must request one using the instructions below once the form becomes available.

Accessing Your Form Electronically

Your Form 1095 will be available in Employee Self-Service:

- Log in using your HawkID and password, then navigate to:

- Time & Pay → Taxes → Year-End Tax Information

Note: DUO authentication is required for secure access.

Requesting a Paper Copy of Form 1095

To request a free mailed copy of your 1095, contact University Benefits using one of the following methods:

- Email: benefits@uiowa.edu

- Phone: 319-335-2676

- Mail: University Benefits, 1 W. Prentiss Street, Iowa City, IA 52242

Please include:

- Your full name

- Employee ID

- Mailing address

- Tax year requested (e.g., 2025)

- A phone number or email address where you can be reached

Reminder

Form 1095 contains important information about your health coverage. One form is issued per employee and includes all covered individuals under your plan. You may need to provide copies to your dependents. Please retain this form for your tax records.

Non-Employee (Retirees and Students)

The University also provides health coverage to non-employees such as students and retirees.

As part of the ACA legislation, the university must provide non-employees with a 1095-B tax form on or before January 31 for the previous calendar year as proof of their health coverage meeting ACA minimal essential coverage requirements offered during that year. This does not include student athletes' secondary coverage.

Tax form 1095-B contains information about health insurance. One form is provided for all individuals covered by the plan. The employee may need to provide copies to dependents. Do not discard the 1095-B form; retain it for your tax records.

There is no online option for non-employees to receive your ACA 1095-B tax forms.

The University of Iowa

As the employer, the university must file all Form 1095-C and Form 1095-B issued to the IRS by March 31st for the previous calendar year.

- The university does not provide 1095-As. The employee should obtain those from the health insurance exchange.

Waiving Health Coverage

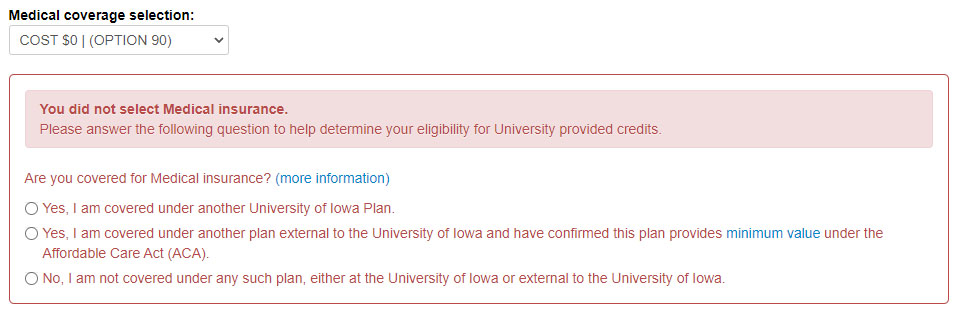

If you waive health insurance through the University and are not covered under another group health plan that provides minimum value coverage, the maximum amount of university credits (general benefit credit and shared savings credits) that can roll into a health care FSA is $500.

If you are a regular benefit-eligible employee who wants to receive the maximum amount of university credits and plans to waive UI health insurance, you must take action within your new hire and open enrollment events each year. This question must be answered each year you choose to waive coverage.

Please note: A spouse or dependent child for whom you seek reimbursement of expenses through the health care FSA must be enrolled in a plan that provides minimum value coverage when the spouse or dependent incurred the expenses. You must notify University Benefits immediately if your enrollment status in other health insurance changes.

To confirm that your plan meets the minimum value standard, check with your plan administrator.

ACA Health Insurance

The University's health plans meet the Affordable Care Act's essential coverage and affordability for employees.

The Affordable Care Act (ACA) requires large employers to offer health insurance coverage to all (at least 95%) full-time employees. The University provides health insurance to regular employees working half-time or more; their eligibility will not change.

Eligibility:

ACA regulations require the University to offer health insurance to all temporary, part-time, and variable-hour employees, including student employees, who meet the ACA eligibility requirements. The ACA eligibility requirements define a full-time employee working an average of 30 or more hours per week within a measurement period.

Active faculty, staff, students, temporary and part-time, who are not currently benefit-eligible but work an average of 30 hours or more per week during the measurement period will receive an offer for a health insurance plan based on their employment status. This offer also includes coverage for dependents, if needed.

Accepting the ACA Offer:

The ACA coverage does not include dental insurance.

The University's contribution to this cost will be charged to the employing department and will not be covered by the Fringe Benefit Pool System. In addition, the employee will be billed monthly for their share, if any, of the premium. The employing department will pay the full or a portion of the premium if an eligible employee elects coverage.

Determining the 30 Working Hours:

Each year stands alone. An employee could qualify for one year but not the following year based on average hours worked.

The University Benefits Office will determine the 30 working hours by using a standard measurable period of Oct 1 through Sep 30 each year for an ongoing employee. New temporary and part-time hires will have an initial measurement period of 11 months, beginning the first of the month following the hire date.

Standard Measurement Period and Stability Period for Eligibility

| Year | Standard Measurement Period | Standard Stability Period |

|---|---|---|

| 2017 | Oct 1, 2015 - Sep 30, 2016 | Jan 1, 2017 - Dec 31, 2017 |

| 2018 | Oct 1, 2016 - Sep 30, 2017 | Jan 1, 2018 - Dec 31, 2018 |

2019 2020 | Oct 1, 2017 - Sep 30, 2018 Oct 1, 2018 - Sep 30, 2019 | Jan 1, 2019 - Dec 31, 2019 Jan 1, 2020 - Dec 31, 2020 |

| 2021 | Oct 1, 2019 - Sep 30, 2020 | Jan 1, 2021 - Dec 31, 2021 |

| 2022 | Oct 1, 2020 - Sep 30, 2021 | Jan 1, 2022 - Dec 31, 2022 |

| 2023 | Oct 1, 2021 - Sep 30, 2022 | Jan 1, 2023 - Dec 31, 2023 |

| 2024 | Oct 1, 2022 - Sep 30, 2023 | Jan 1, 2024 - Dec 31, 2024 |

| 2025 | Oct 1, 2023 - Sep 30, 2024 | Jan 1, 2025 - Dec 31, 2025 |

| 2026 | Oct 1, 2024 - Sep 30, 2025 | Jan 1, 2026 - Dec 31, 2026 |

Included in the average calculation:

The average calculation will include each week (and only those weeks) the individual worked. For example, if a person only worked ten weeks out of the entire measurement period, the average hours worked during those ten weeks would be used to determine eligibility.

Temporary Faculty

Average hours worked per week for temporary faculty not classified as Clinical or Research faculty includes 1 hour of prep time for each credit hour taught plus 2.0 hours of office time for a total of 4 hours (calculated up to a maximum of 40 hours per week). A faculty member teaching ten credit hours in an applicable semester would have a 40-hour average for the weeks of the semester.

Termination of employment during the measurement period

If an employee is terminated during the measurable year and is rehired during the 26 weeks following the termination, then the University Benefits Office will include the prior employment time for counting purposes or eligibility for insurance coverage. Breaks longer than 26 weeks will result in the person being treated as a new hire.

Not included in the average calculation:

The average hours calculation does not include the following:

- Federal Work-Study Program hours,

- non-FMLA leaves without pay,

- or bona fide volunteer hours.

When does coverage begin and end?

If an employee becomes eligible for insurance due to the standard measurement period and elects coverage, the insurance will commence on January 1 following the measurement period.

If an employee with coverage did not qualify in a measurement period, their eligibility for coverage would end the next Jan 1.

University Benefits will offer coverage if a newly hired temporary employee becomes eligible for insurance due to their initial measurement period. Coverage will begin on the employee's 13th month of employment if elected.