Main navigation

Iowa Tax Withholding

The State of Iowa has established a 3.80% flat tax rate beginning January 1, 2025. Additional tax information can be found on the Payroll News site.

Electronic Delivery of W-2

Online delivery is a fast and secure way for University of Iowa employees to receive year-end W-2 and Affordable Care Act (ACA) 1095 forms. Employees who choose online delivery can access their tax forms in Employee Self-Service approximately a week before paper forms mail. Instructions to set your option to online delivery, are listed in these year-end tax form FAQs.

Form 1042-S for Non-U.S. Citizens

The Form 1042-S is for non-U.S. citizens and will be available on the Foreign National Information System (FNIS) between mid-February to mid-March if you’ve selected online delivery of this form. You’ll receive an email notification once your 1042-S is posted. If you have not selected online delivery, we will mail the form no later than March 15. Not all non-U.S. citizens will receive a 1042-S form. A non-U.S. citizen may also receive a W-2.

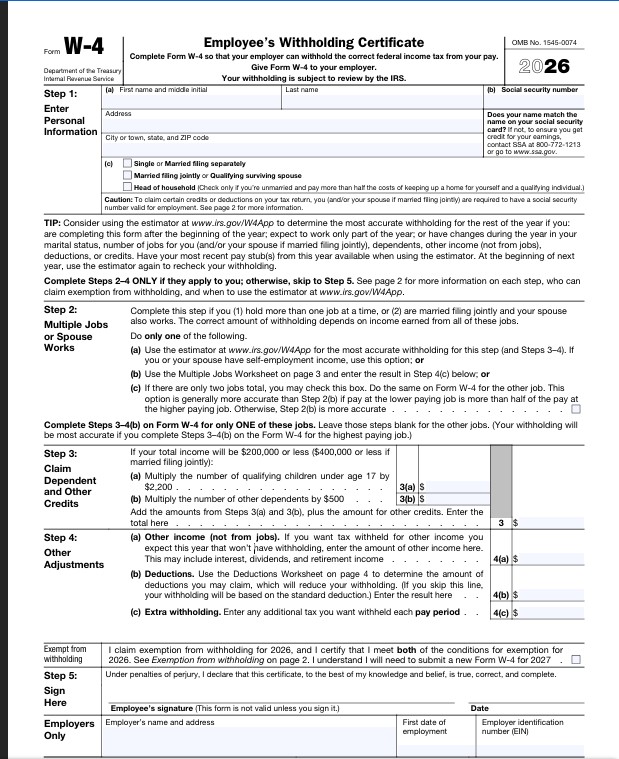

Employee's Withholding Certificates (W-4s)

A Form W-4 determines how much tax your employer will withhold from your paycheck. For further information refer to the W-4 page.

Nonresident Alien Information

- IRS rules for all nonresident alien employees (W-4 forms)

- Payroll Checklist for International Students and Scholars

- Foreign National Information System (FNIS)

The Internal Revenue Service requires that The University of Iowa applies the U.S. withholding and reporting rules consistent with your U.S. tax status, either resident alien or nonresident alien. Thus, we have used the FNIS software to collect and maintain data to determine tax status.

Please complete the FNIS form when requested and return it as soon as possible so Payroll Services can determine your correct tax withholding. Without this information, we will automatically withhold Social Security and Medicare (FICA) tax unless you are exempt through the student FICA exemption process, and we cannot provide you with other tax exemptions which might otherwise be applicable.

- Tax Treaties: The U.S. has income tax treaties with more than 60 foreign countries. However, the existence of a tax treaty does not automatically ensure eligibility. Tax treaties for international students and scholars may provide tax exemption or reduction of taxes withheld. Must meet the following criteria for tax treaty eligibility consideration:

- Possess a valid SSN or ITIN.

- Complete the FNIS form.

- Hold a monthly appointment.

- F-1 status: Attach Form I-20, passport, and I-94 travel history report.

- J-1 status: Attach Form DS-2019, passport, and I-94 travel history report.

- Students and scholars receiving monthly payments through Payroll who would like to apply for tax treaty benefits can send a request via email with their university ID number to payroll-nra@uiowa.edu.

Note: Students from India: Tax treaty works differently. No tax treaty email inquiry is needed.

For further questions, email Payroll Services at payroll-nra@uiowa.edu.

Fellowship Payments

For individuals who receive fellowship payments through Payroll Services, please refer to fellowship payment rules.

Student FICA Information

Students employed in student positions and enrolled at least half-time as University of Iowa undergraduate, graduate, or professional students are exempt from Social Security and Medicare tax, or FICA. For further details, please refer to student FICA information.

Paycheck calculator

To determine what effect your W-4 allowances will have on your net pay, you might want to visit paycheckcity.com, a collection of online paycheck tools. You will need to have a copy of your latest earnings statement.

All deductions listed under before-tax deductions are exempt from federal, FICA, and state taxes, except for IPERS, TIAA, and voluntary retirement savings plan deductions, which are exempt from federal and state taxes.

Other Links

- Internal Revenue Service

- Iowa Department of Revenue

- State of Iowa E-File Information

- How to Check Your Taxes Now to Avoid Surprises Later (pdf) (IRS notice)

- Tax Withholding and Estimated Tax (pdf) (IRS Pub 505 including information for claiming exempt on Form W-4)

- Withholding Calculator on IRS website

- Youth Employment Laws

Year-End Tax Forms Frequently Asked Questions

Who do I contact about year-end tax forms?

W-2, wage and tax statement: payroll-services@uiowa.edu

ACA 1095, employer-provided health insurance offer and coverage: benefits@uiowa.edu

1098-T, tuition statement: ubill@uiowa.edu

1099-MISC, miscellaneous information: misc-1099@uiowa.edu

1042-S, foreign person’s U.S. source income subject to withholding: payroll-nra@uiowa.edu

Does my W-2 include my scholarship/fellowship payments?

No, fellowship payments to U.S. Citizens are not reported on a W-2.

To find the exact amount of your scholarship or fellowship payments visit the Time & Pay/Taxes/Year-End Tax Information section of Employee Self-Service and select the Fellowship Payments option. Learn more about fellowship payments on our Payroll website.

If you are a nonresident alien in F-1 or J-1 immigration status, any scholarship or fellowship payments you receive are subject to 14% federal tax withholding unless you are eligible for tax treaty exemption. These fellowship payments are reported on a 1042-S form.

If I was notified I had an overpayment in 2024, how does this affect my W-2?

If you repaid the overpayment in full in 2024, your W-2 will not reflect the extra amounts for the overpayment. However, if you still owe on the overpayment, your W-2 will include those extra amounts.

If you repay the overpayment in a future year, you’ll receive a corrected 2024 W-2 showing adjustments to Social Security and Medicare taxes (if applicable) and a receipt for the amount repaid. Be sure to include the receipt with your tax return for the year you made the repayment.

Why do my W-2 wages, tips, and other compensation differ from my Social Security and Medicare wages?

Deductions for qualified retirement plans are subject to Social Security and Medicare taxes. However, they are not subject to federal and state income taxes.

If you are a student, you may be exempt from Social Security and Medicare taxes based on your number of enrolled course hours.

Nonresident aliens who are currently in F-1 or J-1 immigration status are exempt from Social Security and Medicare taxes until they have met the IRS Substantial Presence Test (SPT). For more information, please refer to the Student FICA Information.Deductions for qualified retirement plans are subject to Social Security and Medicare taxes, but are not subject to federal and state income taxes.

If you are a student, your Social Security and Medicare taxes may be exempt based on the number of course hours you are enrolled in.

Nonresident aliens who are currently in F-1 or J-1 immigration status are exempt from Social Security and Medicare taxes until they have met the IRS Substantial Presence Test (SPT). For more information, please refer to the Student FICA Information.

How can I receive my year-end tax form (Form W-2)?

University of Iowa W-2 forms are available by the end of January. You can choose to receive these forms electronically or by mail.

Electronically receiving your W-2 is simple, fast, and secure. Plus, you won’t have to wait for the mail since you’ll receive your W-2 about a week before it is mailed. If you select online delivery, expect an email in mid-to-late January, notifying you that your tax forms are available in Employee Self-Service.

To register for electronic delivery of year-end tax forms, visit this webpage.

After you leave or retire from the university, you can still access Employee Self-Service for a limited time – usually 22 months. This lets you get your W-2 and other tax-filing information. If you need help signing in or resetting your password, contact the ITS Help Desk at 319-384-4357. For more information on tech services after leaving the university, visit the ITS site.

How do I get a refund of Social Security tax withholding that exceeds the limit?

If you worked for multiple employers during the year, you might have had too much Social Security tax withheld. The maximum limit for 2024 is $10,453.20. If your Social Security withholding exceeds this limit, you can claim a refund on your personal income tax return.

Is code DD in Box 12 of my W-2 taxable?

No, code DD is for informational purposes only. It shows the total cost of health insurance paid by you and the university. This amount is not included in other boxes on your W-2.

What happens if I put too much money into a Voluntary Retirement Savings Program (VRSP)?

There’s a limit to how much you can contribute to a Voluntary Retirement Savings Program (VRSP). If you had multiple employers in the year, it is your responsibility to ensure you do not exceed the limits. Exceeding the limits could cause tax issues.

Can I get a copy of my W-2 from the Employee Self-Service site if I received it by mail?

You can get a copy of your W-2 from Employee Self-Service after January 31. You can access or print your W-2 at any time and also view tax forms from previous years. To see your year-end tax information, visit Employee Self-Service/Time & Pay/Taxes/Year-End Tax Information.

For instructions to receive future W-2 forms online, visit this webpage.

If I am eligible for the Earned Income Tax Credit (EITC) how do I claim this credit?

Visit irs.gov and refer to Notice 797 in the “Forms and Publications” section. This document will tell you if you qualify and how to claim it. Some states also offer the Earned Income Tax Credit. Check your state tax website for more information.

I'm a non-U.S. citizen, how do I receive a 1042-S form?

For online delivery, you can get a 1042-S form on the Foreign National Information System (FNIS) from mid-February to mid-March. You’ll receive an email when your 1042-S is available. If you didn’t choose online delivery, we’ll send the form by mail before March 15.

Form 1042-S shows earnings covered by tax-treaties and/or 14% taxable fellowship income for F-1 and J-1 students. You need to report this income on your personal income tax return. Not all non-U.S. citizens will receive a 1042-S form; some may also receive a W-2.

What if my name is different from the name on my W-2 or my Social Security Number (SSN) is incorrect on my W-2?

Make sure your Social Security card and W-2 have the same name. If you need to change your name, refer to the ITS website. If you have more questions, email payroll-services@uiowa.edu.

If you are a current UI employee and your Social Security number is incorrect, contact your Departmental Human Resource Representative. If you are a former employee, contact payroll-services@uiowa.edu.

Why am I receiving a 2024 W-2 if I left the university in 2023?

W-2 income is reported when received, not when earned. If you earned income in 2023 but received it in a 2024 paycheck, it will be reported on your 2024 W-2.

What if my current address is different than the address on my W-2?

The IRS matches your name and Social Security number against its database, but the IRS doesn’t verify your address. Be sure to use your current address when filing your personal income tax return.

Why doesn't my annual budgeted salary equal the amount on my W-2?

Certain items, like retirement contributions and out-of-pocket benefit costs, reduce your taxable income. However, they do not reduce your budgeted salary.

Should I receive forms related to the Affordable Care Act (ACA)?

If you work an average of 30 hours or more per week, you’ll receive IRS Form 1095-C which details the university’s health insurance offerings. Students and retirees with university health coverage who are not current UI employees will receive IRS Form 1095-B.

Keep these forms with your tax records, even though you are not required to submit these forms with your taxes. If you have questions, contact University Benefits at 319-335-2676 or benefits@uiowa.edu.

Is my disability income included on my W-2?

No, you’ll get a separate W-2 from Principal Life Insurance Company for your disability income. The W-2 will show your taxable income from Principal disability payments. If you have questions about these W-2 forms, call Principal at 515-248-2742.

Why are my W-2 earnings less than last year even though my salary is higher this year?

Your pre-tax deductions, like health insurance or voluntary retirement contributions, may vary from year to year. You may have also received a bonus last year that you did not get this year.

I didn’t get paid by the university in 2024, so why did I receive a W-2?

There are two reasons you received a W-2:

You receive disability income and have life insurance coverage that exceeds $50,000, which the university provides. Any amount over $50,000 is reported on a W-2.

In 2024, there was an adjustment made to your income from a previous year. This could be a retroactive correction of pretax benefits.

Can I receive assistance filing my income taxes?

The Volunteer Income Tax Assistance program helps low- and moderate-income taxpayers in the Johnson County area with their taxes. As part of the Johnson County Earned Income Tax Outreach Campaign, it assists people in preparing and filing their taxes. You can find more information on their websites.