Main navigation

Welcome to the Benefits Enrollment Help Center

This page is designed to support you through each step of the benefits enrollment process. Below, you'll find a comprehensive, step-by-step guide that walks you through the entire enrollment system as well as a video.

For more targeted assistance, use the navigation menu at the top of the page to access individual sections—such as Health Coverage Enrollment, Dental Coverage Enrollment, Group Life Insurance Enrollment, and more. Each section provides specific instructions to help you complete your enrollment accurately and confidently.

Our goal is to make the enrollment process as straightforward and informative as possible, helping you to secure the coverage and support you deserve.

How to Enroll in Your Benefits Online

To complete your benefit elections online, follow the steps outlined below:

- Log in to Employee Self-Service

Go to hris.uiowa.edu and sign in using your HawkID and password.

If you experience login issues, use the "Forgot Password" link or contact the ITS Help Desk for assistance. - Navigate to the Benefits Enrollment Section

From the main menu, select:

Benefits & Wellness ⇢ Benefits ⇢ Benefits Enrollment - Start Your Enrollment

Choose the link labeled:

"OPEN - Edit Your Benefit Elections" to begin. - Review Important Information

On the next screen, you will see an Important Information section. Please read this carefully before proceeding. - Agree and Continue - Add and Review your Dependents/Beneficiaries

In the bottom-right corner of the screen, click the black button labeled:

"I Agree - View and Update Dependents/Beneficiaries."

Select the "Adding/Updating Dependents and Beneficiaries" accordion below for more instructions.

Adding/Updating Dependents and Beneficiaries

Adding/Updating Dependents and Beneficiaries

Adding and verifying your dependent and beneficiary information is the first step in completing your enrollment.

If you plan to include dependents in your coverage, you must complete this step first; otherwise, they will not appear on the enrollment form and cannot be added.

If you do not see your dependent or beneficiary listed under "Dependents/Beneficiaries Not Covered", you must exit the enrollment screen and follow the steps outlined below.

- Select the black button labeled "I Agree—View & Update Dependents/Beneficiaries."

- "Review Dependents/Beneficiaries" screen:

- To add a new dependent or beneficiary, select the blue "Add New Dependent/Beneficiary" button at the bottom of the page.

- On the next screen, "Change Dependents/Beneficiaries," you will be prompted to enter the dependent's legal first and last name, relationship to you (e.g., child, spouse, sibling), date of birth, sex, and social security number. Once completed, select the "Submit" button.

- You will continue this process until you add all dependents you want to cover on insurance and any additional beneficiaries. Then, you will return to the main Benefits Enrollment screen, and you can then select the gold button labeled "I Agree - Continue to Benefits Enrollment."

- For current employees with an established list of dependents and beneficiaries already, you should review the list to ensure it is up-to-date.

Dependents

Children may be covered by health and dental insurance until the end of the calendar year when they turn 26 without tax implications. Coverage for single children who are full-time students or disabled can continue as long as they remain in that status.

The Internal Revenue Service (IRS) has determined that if an employer allows employees to insure dependent children past the age of 26 who do not qualify as the employee’s tax dependents, there is a value that must be added to the employee’s taxable salary when reporting income earned on the annual W-2.

Taxable health and dental information for Faculty and Staff

Beneficiaries

Check to make sure the beneficiaries listed are correct. You can make any additions at this time. Later in enrollment, you will be asked to assign beneficiaries when selecting eligible insurance plans. Anyone you plan to designate as a beneficiary must appear on this list.

To correct beneficiary or dependent information, permanently delete a beneficiary, or if a beneficiary is not appearing under a benefit area where you want to cover them, please contact the University Benefits office.

As you are enrolling online, there are a few things to remember:

- You will always be the beneficiary of Spouse and Dependent Life Insurance.

- Life insurance proceeds are divided between primary beneficiaries. Contingent beneficiaries only receive proceeds if there are no living primary beneficiaries.

Final Steps: Electing Your Benefits

Now that you've finished adding, changing, or removing your dependents and beneficiaries, it's time to complete your benefit elections.

- Return to the List of Open Events

After saving your dependent and beneficiary updates, you'll be directed back to the Open Events page. - Begin Your Benefit Elections

Choose the link labeled:

"OPEN - Edit Your Benefit Elections" - Agree to Continue

On the Benefits Enrollment screen, locate the gold button in the bottom-left corner.

Select "I agree - Continue to Benefits Enrollment" - Begin Electing Your Benefits

On the next screen, you'll begin selecting your benefit options.

You'll also assign your dependents and beneficiaries to the appropriate coverage plans. - Explore Each Benefit Option

Use the menu at the top of the page to navigate through each benefit category (e.g., health, dental, life insurance).

Each section includes general enrollment instructions to help guide your choices.

How to Enroll Video

A step-by-step tutorial on how to enroll in benefits through Employee Self-Service.

HawkID or HealthCare ID & Password

You will need your HawkID or HealthCare ID to log in to Employee Self-Service.

Duo Security Two-Step Login

Before you begin, make sure you have set up your two-step login with Duo Security.

Gather Personal Info

Gather personal information for each person you are enrolling.

This includes full legal names, birth dates, and social security numbers for each dependent.

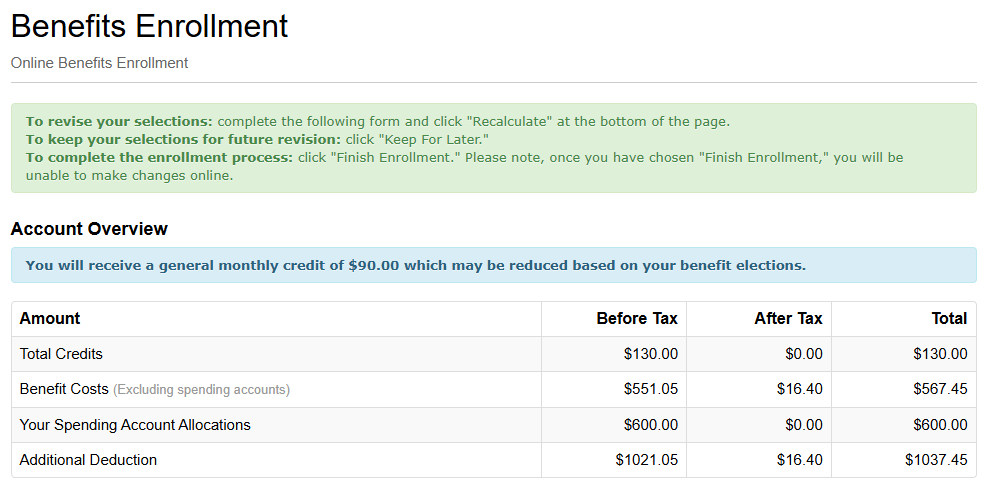

Benefits Enrollment Account Overview

The Account Overview shows how your benefit choices affect your paycheck. It summarizes your credits, costs, and any additional deductions.

General Monthly Credit: You receive a monthly credit of $90 from the University to help offset your benefit costs. This amount may change based on what you select.

Total Credits: This is the total amount of credits you are receiving in a month to use toward pre-tax benefit costs - your general credit plus any additional shared savings credits you receive from your benefit selections.

Benefit Costs (Excluding spending accounts): This shows the cost of the benefits you have chosen, before and after Tax, with the total of both added together in the last column of the chart. This does not include your spending account allocations, if applicable.

Spending Account Allocations: If you elected to contribute to a Flexible Spending Account, this section shows how much you’ve allocated.

Additional Deduction: This is the amount that will be deducted from your paycheck after applying credits to your elections, if applicable.

Columns

Before Tax: Amount deducted before taxes (reduces your taxable income) - This includes your credits, health, dental, group life, voluntary life, AD&D, and FSA contributions.

After Tax: Amount deducted after taxes - this includes Spouse/dependent life and/or any other voluntary benefit you may enroll in.

Total: Combined amount for each category.

Account Overview Example

Below is an example of an employee's Benefits Enrollment Account Overview who enrolled in the following for 2026:

- General Benefit Credit - ($90)

- UIChoice Family coverage - $488

- Dental II Family coverage - $30.80

- Group Life, $50,000 - ($40) shared savings credit

- Voluntary Term Life, 3.5x salary - $26.25

- AD&D, 200k Family - $6.00

- Spouse/Dep Life 40/20 after-tax - $16.40

- Health Care FSA - $100

- Dependent Care FSA - $500

Once the employee selects the blue "Recalculate" button, their Account Overview appears with the final calculation of their benefits as the image shows below.

How to Calculate the Benefits Account Overview

Account Overview Calculations Explained

How to calculate the Account Overview using the assigned numbers above for each benefit:

Total University Credits:

Add:

General Benefit Credit = $90

Group Life Shared Savings Credit = $40

Total Credits = $90 + $40 = $130

Calculate Benefit Costs (Before Tax, Excluding Spending Accounts):

Add:

UIChoice Family = $488

Dental Family = $30.80

Voluntary Term Life = $26.25

AD&D = $6.00

Total Benefit Costs = $488 + $30.80 + $26.25 + $6.00 = $551.05

(Spouse/Dependent Life is after-tax, so exclude it from pre-tax calculation)

Apply University Credits to Benefit Costs:

Subtract:

Total Credits = $130

Benefit Cost = $551.05

Remaining Benefits Cost = $551.05 - $130 = $421.05

(This means all credits are used, and you owe $421.05 pre-tax)

Your Spending Account Allocations:

Add:

Health Care FSA Election = $100

Dependent Care FSA Election = $500

Total Spending Account Allocations = $100 + $500 = $600

These are additional elections, so they add to your pre-tax deductions.

Additional Deduction

Add:

Pre-Tax Benefit Cost = $421.05

Spending Account Elections = $600

Total Pre-Tax Additional Deduction = $421.05 + $600 = $1,021.05

Add:

After-Tax Benefit Cost = $16.40 (spouse/dependent life)

Total Additional Deduction = $1,021.05 + $16.40 = $1,037.45

Summary

- University Credits: $130

- Benefit Costs (Pre-Tax): $551.05 + $16.40

- Remaining Credits: $0 (all used)

- Additional Deduction: $1,021.05 pre-tax, and $16.40 after tax = $1,037.45

Example: Employee who has leftover credits but is contributing extra to a FSA account

- General Benefit Credit - $90

- UISelect, Employee Only - $0

- Dental Employee Only - $0

- Group Life, $50,000 - $40 shared savings credit

- Voluntary Term Life, 3.5 times - $5.74

- AD&D, 300K single - $4.80

- Health Care FSA - $250.00

How to calculate the Account Overview using the assigned numbers above for each benefit:

Calculate Total University Credits:

Add:

General Benefit Credit = $90

Group Life Shared Savings Credit = $40

Total Credits = $90 + $40 = $130

Calculate Benefit Costs (Before Tax, Excluding Spending Accounts):

Add:

UISelect Employee Only = $0

Dental Employee Only = $0

Voluntary Term Life = $5.74

AD&D = $4.80

Total Benefit Costs = $5.74 + $4.80 = $10.54

Apply University Credits to Benefit Costs

Subtract:

Total Credits = $130

Benefit Cost = $10.54

Remaining Credits = $130 - $10.54 = $119.46

Leftover credits ($119.46) will default to the health care FSA account if they are not used towards any other pre-tax benefit costs:

Your Spending Account Allocations:

Health Care FSA Election = $250

Remaining Credits Already in the Account = $119.46

Additional Deduction = $250 - $119.46 = $130.54